Wasatch County Tax Issues 2019-2024

Scroll down this page for more NEW 2023 tax info and resources for you to educate yourselves on recent property tax notices….. and for our efforts to correct this problem for YEARS!

4-17-24 The Utah State Legislative Auditor’s office just released their Audit of Property Tax Systems to the Legislative Audit Committee. It confirmed what we knew all along. There are MAJOR inconsistencies statewide at the local Assessor level, and the Utah Tax Commission has NOT been doing their job by conducting any oversight or enforcement of state code. Watch meeting here (go to :47 min into recording) – Presentation by auditors Audit Summary FULL AUDIT HERE Click on Wasatch County to see our info here. SALT LAKE TRIB ARTICLE By Robert Gehrke

See the Legislative Auditor’s website where they release ALL their audits.

UTAH’S PROPERTY TAX SYSTEM- AUDIT’S KEY FINDINGS

-RECOMMENDATIONS

1.1 The Property Tax Division has been passive in their oversight role

1.2 Development of a division-level strategic plan will help the division better oversee the counties’ role in assessing property

1.3 More training for assessors on mass appraisal provided by the Property Tax division will help improve assessors effectiveness

2.1 Access to more sales data could help assessors improve their accuracy

3.1 Counties should provide property owners with more data on valuation forms

3.2 Taxpayers would benefit from greater clarity around the truth in taxation process

4.1 County board of equalization processes could benefit from greater transparency and uniformity in the appeals process

_____________________________________________________________________

December 2023- Some Wasatch County landowners have filed a lawsuit against the Wasatch County Assessor and the Utah Tax Commission for the failure of Wasatch County to follow state code on required fairness of property tax assessments. KPCW REPORT PARK RECORD REPORT LETTER TO THE EDITOR

July 27, 2023- Wasatch and Summit Counties refuse to participate in new State Auditor John Dougall’s property tax transparency website! This is public information other Utah taxpayers are receiving! See FOX13 report here Watch KUTV report here/ Auditor complains about our counties KPCW REPORT A bit of arrogance from Summit County, considering their total mess of unfair taxing of properties in 2022, and before!

KSL REPORT – “Unfortunately, some assessors do not welcome greater access to public assessment data,” Dougall said. “I’m concerned with those county officials who create barriers, making it difficult or costly for taxpayers to access, analyze, and use public information. Over the past couple of years, Wasatch and Summit County property owners expressed concerns with inequitable assessment in their counties. Yet their assessors failed to provide public information for this tool.”

**Email our County Councilmen NOW to demand that Wasatch & Summit Counties release the PUBLIC TAX information to the State Auditor! (copy & paste) Council@wasatch.utah.gov, spark@wasatch.utah.gov, dgrabau@wasatch.utah.gov, assessor@wasatch.utah.gov

SUMMIT CO Council contact info: https://www.summitcounty.org/Directory.aspx?did=28

The State Auditor has been working on a NEW website- propertyvalues.utah.gov for ALL Utah property owners to research their own property and their counties in general. We reported below (scroll down to January 2023) that the State Auditor’s office has been investigating complaints about Wasatch County’s broken property tax system. Now the auditor’s office is requesting the info from each county, and our county will not release OUR PUBLIC INFO so our own citizens can use this invaluable website.

GRAMA REQUEST- July 22, 2023 – As you are receiving your 2023 tax notices, we just GRAMA requested some of last year’s 2022 APPEALS done by our Wasatch County Board of Equalization (BOE). We heard stories from property owners who appealed last year’s taxes, and how some were denied even though they brought in loads of pertinent info. The attachments below help to see if there were any systematic patterns in the denials or approvals to show a “fair and equitable” system of APPEALS. You will see who were randomly approved, declined and how much their property may have been lowered. You can see who owns the property, but it does not have the property addresses. These were presented at public County Council meetings so they could keep track of the process long after the normal deadline of September 2022. Excel spreadsheets: BOE Approvals for 11-09 12-21 BOE approvals 12-07 BOE approvals 10-11 BOE for approval

**For those of you confused about your new 2023 TAXES (which is most of us) Both Wasatch and Summit Counties are similar in these issues, but these are Wasatch Co’s numbers.

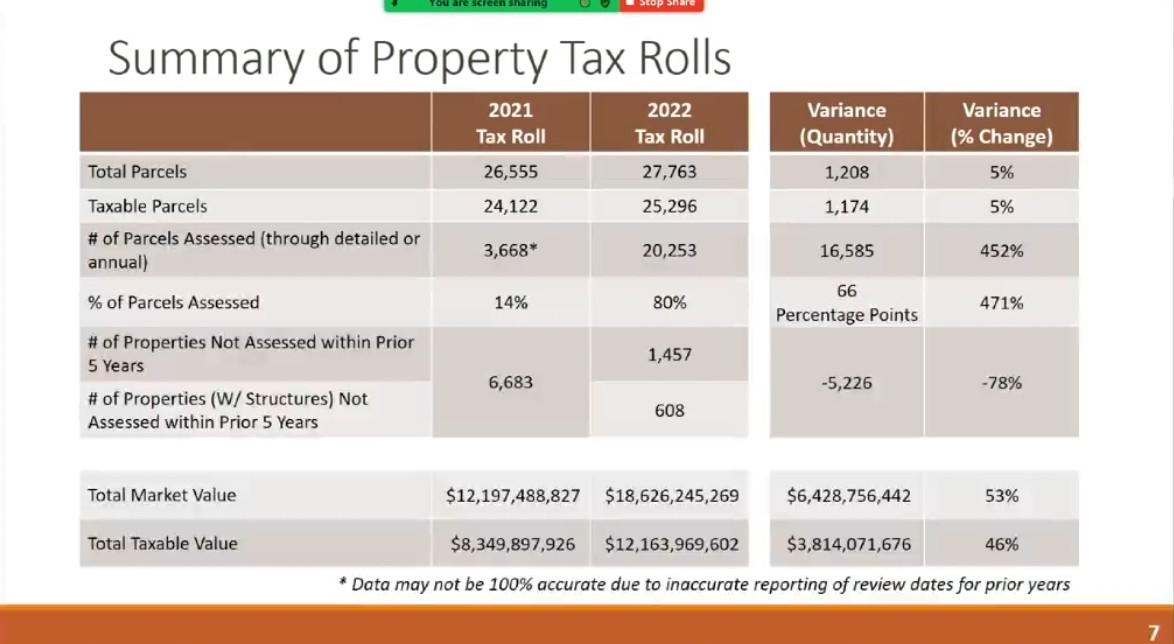

Here’s a great presentation of last year’s Wasatch County Assessment process of updating properties to help you understand the problem- Analysis of 2022 PPT- 3-2023

Here are a couple scenarios that may apply to you:

1)Why did your taxes go down this year?

In 2022, the improved properties (houses built on a lot) that were assessed received an average market value increase of 87%, which made a substantial increase in the total County valuation. Empty lots that were assessed received an average market value increase of 284%. In 2023, some of the properties that were not assessed in 2022 were assessed in 2023, contributing to a further increase in the tax base or total County valuation. Last year, the County assessment process failed to re-appraise 34% of the 26,092 taxable county properties even though it is required to do so by State Law (State Code 59-2-303.1). In the simplest terms, the tax rate is determined by dividing the total budget required to run the County divided by the total property valuation. So, when the valuation increases and the budget requirements are the same, the tax rate goes down.

2) Why did my taxes go up drastically this year?

If the property tax assessment process was handled according to state law, the HUGE tax increase for some should never be happening. No property owner should be faced with a drastic increase in ONE year because they have been neglected for a decade, or more. We understand the frustration in trying to pay your unexpected ballooning tax bill you did not budget for. That’s why the above mentioned State Auditor website is so key in seeing how our county is assessing ALL properties.

First of all, check to see if your property is a PRIMARY or SECONDARY designation. Secondary property pays 100% of market value and that would almost double your bill. Also, those properties that had market values that did not incrementally increase over time, mirroring the actual real estate market, and were not assessed in 2022, did not contribute to the sizable total county property increased valuation that others had in 2021 and 2022. That 34% which had not seen any increases in market value in years, which includes all commercial properties in the County, actually received a 20% to 21% tax reduction LAST YEAR because the rate went down but your property didn’t get reassessed higher. Last year’s assessment process failed to comply with Utah State Law, too. The 2022 tax rate was about 27% higher than it should have been based on this analysis. So the rest of the properties, who paid their fair share,actually paid a higher RATE than they should have. Not fair and equitable!

Those same property owners that benefited in 2022, and received a reduction in their taxes last year, are likely to see a major increase in their property valuation in 2023 and, subsequently, much higher taxes. So to them it seems unfair that their taxes doubled or tripled, but they were just catching up to the other properties.

** The Good and Bad News About This Year’s 2023 Tax Notices

There is good news and bad news in our property tax notices this year. Here are the results of a preliminary analysis developed by one of our Wasatch County Taxpayer Association members who lives in Tax District 14 in unincorporated Wasatch County. If you live in another Tax District (there are 33 tax Districts in Wasatch County), Wasatch School District taxes are the same for everyone since they apply to all County taxable properties. You may live in certain municipalities, utility districts, etc that may alter your personal amount.

The discussion below used information on his tax notice and was prepared for his HOA members. The following observations are based on a limited analysis of the 2023 tax rates. Note the discussion below refers to tax rates. To convert tax rates into your tax dollars- multiply your 2023 Taxable Value as shown on your Preliminary Tax Notice by the tax rate.

- Many homeowners will see a small reduction in property taxes in 2023 as the total assessed value of taxable property in the County has apparently increased, which results in a lower tax rate.

- The individual property assessed values for 2023 have not changed from 2022 for some taxpayers. The average assessed value in his subdivision increased from 2021 to 2022 by an average of 112%. We expect that most, if not all, of the property assessed values for 2023 in his subdivision are the same as the 2022 assessed values.

- The total tax rate for Tax District 14 in 2022 was 0.009322. The Wasatch School District tax rate portion in 2022 was 0.006635 or 71.2% of our total taxes. SEE this Utah Tax Association explanation of STATE school spending and what each line item on your tax notice is for. 2022-Utah School Spending

- If the School District proposed 2023 tax rate is not approved, the School District portion of the total tax rate will decrease to 0.004876 or 23.7% in 2023. Wouldn’t that be nice!

- However, the School District tax increases could be approved. The total School District portion of our tax rate in 2023 will be 0.006391 or 31% above the rate if the proposed taxes are not approved. If you want to question or make comments to the Wasatch School Board about their proposed TAX INCREASE, attend their required Truth in Taxation hearing on August 16 at the District Offices at 101 E 200 N, Heber, Utah at 6pm.

- Once the High School is completed, the School District will increase our taxes to cover the future operating costs (teachers, administrators, maintenance & janitorial staff, utilities, etc.), so the 3.7% reduction in our taxes this year will surely disappear in the near future.

- If the School District request is approved, the total County tax rate will decrease from 0.009322 in 2022 to 0.008637 in 2023. This is a 7.3% decrease. This decrease is primarily due to increased property valuation in the County. This is still good news, but I would rather have the much lower taxes as described in Bullet 4 above – a 23.7% decrease. Comparing the 2022 School District tax rate to the proposed 2023 tax rate, you will see there is a slight decrease – 3.7%.

What should you do about your taxes?

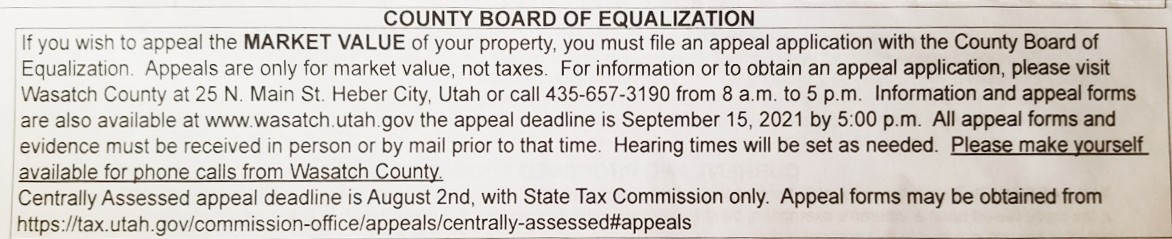

**WTPA supports ALL taxpayers appealing their taxes if they feel that their property is not equitably assessed comparable to similar properties. Filing deadline is September 15, 2021 5:00 p.m. Go to Assessor’s webpage for more info: https://www.wasatch.utah.gov/Assessor

If you like high taxes, just pay them. If you don’t like high taxes, attend the Truth in Taxation hearings posted on your tax notice, to the right of the line item that is asking for an increase. You should voice your opinion about the Wasatch County School District’s proposed 47.6% increase shown on your tax notice. Remember, this is not the end of tax increases for the School District. As stated above, there will be more increases in the near future to operate the new facilities!

Upcoming TRUTH IN TAXATION Hearings-

SEE the list- Wasatch Co Proposed Tax Increases 7-2023

____________________________

January 30, 2023- Robert Gehrke reports, from the Salt Lake Tribune, on the problem!

January 19, 2023– The State Auditor, John Dougall, presents his budget to the Executive Offices and Criminal Justice Appropriations Subcommittee, at the State Legislature, and goes into detail about our Wasatch County property tax issue and their new data dashboard that will help taxpayers in the future!! Click here to watch the presentation (click on meeting “markers”, then agenda item #4 to prompt recording) Auditor’s Presentation – 2023 State Auditor- budget PPT. (It must be noted that their staff member took only 3 WEEKS to get STATEWIDE property data, yet the Utah Tax Commission said it would take them 5 YEARS just to get Wasatch County figured out when we had a meeting with them in June 2021. Ridiculous!) Park Record Newspaper article 1-18-23

MUST READ*** January 10, 2023 — The State Auditor’s Office released a Final Letter to Tax Commission- 1-10-23 to address major deficiencies in the Utah Tax Commission’s oversight responsibilities, per state code and the Utah Constitution. They reference the Wasatch and Summit County’s taxpayer complaints that drove their investigation. Please read the assessment, but also attached is the very weak response letter by the Tax Commission to answer for these severe conclusions and recommendations. It does not begin to relieve the taxpayers’ concerns for their lack of action, or their total failure to implement their state mandated duties. The taxpayers feel their best interests were not served by the Utah Tax Commission in the past decade.

We do want to thank the State Auditor’s Office for their genuine concern, their professionalism, and their diligence to uncover and validate the extensive, long-term taxpayer concerns. We will keep you informed of the follow up, which the State Legislature SHOULD address in this upcoming General Session starting January 17, 2023. But will they…..?

________________________________________________

MUST LISTEN**** SEPT 22, 2022 Utah Tax Commission Meeting where Summit County taxpayers go to discuss their tax assessment problems with the UTC. Agenda for Sept 22, 2022 UTC Meeting AUDIO of meeting HERE (go to 3:30 into recording to start discussion) The property tax division of the UTC admit to not following state code, and the questions asked by the commission to them is concerning. They do not think they have statutory authority to fix these problems, and ask the public to answer their questions on their authority. The commission should KNOW this.

AUG 8, 2022 Governor Cox attended a Heber Valley Chamber Luncheon where he was told by our WTPA representative about our tax problems in Wasatch and Summit Counties. He asked for a follow up email by our representative to address the detailed issues. Gov Cox then had his office send a letter to the Tax Commission for follow up. The Tax Commission sent a disappointing letter back to the Governor’s office explaining their lack of oversight. That’s as far as the Governor’s office took this issue, and never got the problem corrected, as far as we know….. UTC’s response to Governor’s office- Executive Summary UTC response to GOV Wasatch County 2022 Summit County website referenced in meeting

JULY 2022- We have been working with the Wasatch County Assessor and the Council for years to encourage them to correct a decade-long disparity in our property tax system. This July 2022, we will see the result of the egregious imbalance of the taxpayers who have been assessed correctly, and those who have NOT been paying their fair share for YEARS. We try to encourage fiscal responsibility in all our taxing entities, and also lower taxes in general with thoughtful policies. Even though some taxpayers will see a dramatic increase this summer, it’s due to a decade long negligence by our County Assessors and the Utah State Tax Commission to NOT ensure an equitable system. (scroll down to see the UTC “values” and job requirements) This problem should have never gone this long, so now that our property values have doubled in the last 3 years it has made the problem even more pronounced and unfair.

WTPA supports ALL taxpayers appealing their taxes if they feel that their property is not equitably assessed comparable to similar properties. Filing deadline is September 15, 2021 5:00 p.m.

July 2022- TAX APPEAL ALERT!! ***** There will be an appeals process for taxpayers feeling they are over assessed compared to other properties, or just because of the value itself. Here’s the form to appeal- PT-10 FORM-Request for Review See details on BOE (Board of Equalization) process here: Clerk’s Office Webpage. Here’s a helpful website that offers a service to check your taxes in relation to similar properties in your area- cutmytaxes.com. It works well in Wasatch County, too. Scroll down to see more about appealing….

Picture- County Assessor’s summary of property market value correction in the past year. (click to enlarge)

You will be able to look up your new 2022 property tax bill when they are mailed at the end of July. Some property owners will see a doubling or tripling of their market value which will correct their previously incorrect value- causing a substantial increase in their taxes owed. You may feel picked on, and unreasonably targeted, but understand it’s because your property has NOT had the current market value applied for YEARS. If you have been paying the proper market value for your property, you should actually see a lowering of your taxes due to the rate adjustment decrease to balance the substantially increased TOTAL market value in the county.

***Check YOUR property here on the county webpage map that we have been using to research properties. Click on property lot (if it’s in a subdivision click on arrow at top of property link to get owner info, then scroll down to see a file picture for property tax info link) Check your properties, your neighborhood for equity, and out in the county, too.

***Another way to research your, and other comparable, properties- Assessor’s Office Tax Lookup Service Main Assessor’s Office webpage

Here’s the most recent Assessor’s progress report correcting the market values countywide- Wasatch Co Assessor Prop tax update 5-18-22 So far, the total market value of the county has risen by $3 BILLION with the 2021-22 corrections, and it’s not completed yet.

The Heber City Council was given a recent presentation that explains the basics. The presentation is here: Listen to Matt Hurst (Utah Tax Commission) discussion**(It starts 30 MIN into recording)

________________________________________

As of March 2022, we are STILL trying to straighten out this current, unfair system. The MUST listen video of the latest March 9, 2022 meeting (click on agenda item #2- Assessor office, to prompt recording) will help you understand the issue. Here are some random examples of properties with problems, to try and show taxpayers some of these issues. Keep in mind that certain areas of our county have been re-assessed every year or so, with their market values being caught up to 2022 values. But the county is littered with these properties, all over the county, these are NOT just a select few:

The County Assessor has the same sold info (in examples below) that we have.

Prop Tax Heber Lots– We have seen market values in old town Heber City everywhere from $150k, $115K, $85K, $40K . EVEN $8,500!

County Home 1 acre– Modest home, no subdivision, notice market value for county 1 acre lot! No market value increase since 2011.

Midway home 1+ acre– Midway home and huge barn, no market value increase since 2015.

Midway new home– New construction, still showing vacant lot market value.

Newer Midway home – recent sale

High end home sale – Large home on 25+ acres, recent sale.

We have been concerned that even after knowing about this problem for YEARS, most (NOT ALL!) on the County Council still don’t (care to?) understand the overwhelming scope of the problems, and refuse to pressure the County Assessor and the Utah Tax Commission to to do their state mandated jobs. See the UTC VALUES:

On the UTC website- VALUES

- We must uphold our public trust.

- We value quality, which is the balance of efficiency and effectiveness.

- We value job expertise and knowledge with consistent and dependable application of laws, rules, practices and procedures.

- We value integrity, including honesty, trust and respect for self and others.

- We value clear, meaningful and concise communication with customers.

- We value self-motivated employees and environments that encourage initiative.

- We value empowered employees with their attendant accountability.

What a crock…. This problem has been going on for at least a decade, and the UTC seems to have been either oblivious, or negligent. Also, The Wasatch County Assessor validated that Wasatch County’s tax system has been done correctly, per state code, with this official state form- Wasatch Assessor- validate correct process 6-2021

We have spoken to County Council people, the County Assessor, the UTAH State Tax Commission, our State Representative, and even state officials to get SOMEONE to fix this problem. Until everyone calls or emails their politicians will anything get straightened out on a widespread, comprehensive level. Read below to hear our concerns.

Here’s the webpage map we use to search properties. Click on property lot (if it’s in a subdivision click on arrow at top of property link to get owner info, then scroll down to see a file picture for property tax info link) Check your properties, your neighborhood, out in the county too. NO equity or fairness on WHO is paying full market value and who isn’t. Sometimes the report says it was reassessed in Nov 2021 (and market value says Jan 1, 2022)

Research your, and other comparable properties, here too- Assessor’s Office Tax Lookup Service Main Assessor’s Office webpage

Email us info if you see other examples, or info: wasatchtaxpayers@gmail.com

Stay Tuned……

$$$$$$$$ Aug 2021- Wasatch County Property Tax Inequities 2021

WTPA has been aware of the disparities of assessed taxes of individual Wasatch County property owners for years because of a flawed county system of assessing properties annually. Here’s our recent letter to the County Council explaining in detail our concerns and our expectations of this process being corrected as soon as possible- WTPA County Tax inequities letter 7-17-21 PLEASE Email your County Council to support our efforts at: Council@wasatch.utah.gov

**Heber City is also having a Truth In Taxation Hearing on Wednesday, Aug 11, 2021, 7PM. They should NOT raise taxes and make this tax assessment problem worse. Email your comments to them at: CCPublic@heberut.gov Here’s our Wasatch Wave Letter to Editor-Heber Tax Increase ****Go here to learn more about the Heber Tax Increase

WTPA supports ALL taxpayers APPEALING their taxes if they feel that their property is not equitably assessed comparable to similar properties. Here’s a helpful website that offers a service to check your taxes in relation to similar properties in your area- cutmytaxes.com. It works well in Wasatch County, too.

AUG 2021- TAX APPEAL ALERT!! ***** There will be an appeals process for taxpayers feeling they are over assessed compared to other properties, or just because of the value itself. Here’s the form to appeal- PT-10 FORM-Request for Review See details on BOE (Board of Equalization) process here: Clerk’s Office Webpage

(click picture to enlarge)

Who Should Appeal?? 1) If your property tax has increased every year, or near every year, you may have been a victim of unequal tax assessment. Each property should be adjusted every year to current market conditions, but this is not happening with any consistency throughout Wasatch County. Some properties have received sizable increases each year while others have received no increase for years. The fairness of your assessment requires equal and consistent treatment. This must stop immediately and a plan put in place to return property values to equity. Those who have been over charged should have continued increases halted and frozen until the whole county values have been equalized.

2) If your assessed home value has increased more than 60% over the past five years you should highly consider an appeal due to equity. Find your 2016 tax form and multiply the home value by 1.60; If your current value is higher than your answer, then you should definitely appeal.

***If you don’t have your 2016 tax notice, you may get one at the County Treasurer’s Office. Research yours, and other comparable properties here- Assessor’s Office Tax Lookup Service Main Assessor’s Office webpage

We believe that the County may have been “sales chasing” which occurs when an appraisal district focuses on assessing only an individual property at its sales price and not re-assessing other properties in the corresponding sub-market. When an owner is a victim of sales chasing, equity can be a particularly effective defense methodology.

Here’s the Utah Code section for appeals.

Excerpt UTAH CODE- Effective 1/1/2021— WHEN TO APPEAL!

“3(a)Except as provided in Subsection (3)(b) and for purposes of Subsection (2), a taxpayer shall make an application to appeal the valuation or the equalization of the taxpayer’s real property on or before the later of: September 15 of the current calendar year -or- the last day of a 45-day period beginning on the day on which the county auditor provides the notice under Section 59-2-919.1.”

Utah Code 59-2-303.1(4) requires the Utah Tax Commission to be responsible and correct the problems. Here’s the complete property tax section of the Utah Code

***If the taxpayer is not satisfied with the outcome of appeal, they can appeal directly to the Utah State Tax Commission See Utah Code here.

Excerpt Utah Code- 59-2-1006. Appeal to commission — Duties of auditor — Decision by commission.

“The commission shall decide all appeals taken pursuant to this section not later than March 1 of the following year for real property and within 90 days for personal property, and shall report its decision, order, or assessment to the county auditor, who shall make all changes necessary to comply with the decision, order, or assessment.”

__________________________________________________________

2020- The $150 MIL Wasatch County School Bond did not pass in November 2019, which was good for many reasons. One of which is because the taxpayers did not have the correct tax info of that bond, and the impact to the taxpayers was not reported correctly. Go here to read the results of that election.

2020- The $150 MIL Wasatch County School Bond did not pass in November 2019, which was good for many reasons. One of which is because the taxpayers did not have the correct tax info of that bond, and the impact to the taxpayers was not reported correctly. Go here to read the results of that election.

1-17-2020 Here’s the latest info on the $1 BIL tax error. KPCW report and the letter from Wasatch County- 2019- PTax Correction Breakdown- Wasatch Co.

_____________________

We all had information from the county of an incorrect tax rate due to the county thinking our total assessed value was higher than it should have been. So the school bond tax impacts were incorrectly reported by everyone. An Assessor’s Office $543 MIL clerical error on the November 2019 property tax bill has caused public entities to have a shortfall. Please read our full explanation: “As a bit of background, you should know that government entities propose a budget for the upcoming year. The assessor’s office compiles all valuations of property in the County and reports those numbers to the State of Utah. Then the state puts those two components together and comes up with a certified tax rate to be applied to the taxable value of the properties in the County. This year we got into trouble with the over valuation error of one single property in our county. This “error” actually has given taxpayers a break this year! It may not seem so considering the amounts that many taxpayers were forced to pay in 2019, but it would have been even worse if the correct certified tax rates had been applied. This is so confusing to most that we cannot begin to explain the process, but we trust that this will all be worked out in the end and future safeguards will be implemented. It still is not quite clear HOW this happened, though, so it’s too early to explain that. In the meantime, the County Assessors have an opportunity to assess more properties to bring them to market value, which will lighten the burden on those who were first in line to be reassessed and have their tax payments skyrocket. Once everyone is reassessed, things should start to even out a bit. We encourage the county taxing entities to find a way to absorb the loss of funding in their budgets and get on down the road until the next budget year. We trust again that the State of Utah Tax Commission will also lend a helping hand in what path should be taken.”

The result of the error means $6 million will not be collected in 2020: $1 million for the county’s budget; $4.3 million for the Wasatch School District; $250,000 for the fire district; $200,000 for the Central Utah Water Conservancy District; and nearly $150,000 for the County Parks and Recreation District. It will need to be corrected in the next few years. Property Tax Correction- Nov 2019 KPCW report To listen to the Wasatch County Council discuss this problem go here. Another issue is the primary and secondary home tax rates are getting mixed up. Listen to citizens here.

_________________________________________

Other tax info:

***TO WATCH ALL COUNTY COUNCIL, PLANNING COMMISSION AND SPECIAL SERVICE DISTRICT meeting videos go here. (Notice the “upcoming meetings” to find future meetings, and “2019” “2018” etc, to find past meeting videos.) Also, click on each agenda item when viewing an individual meeting, and it will prompt you to that discussion in the video.

***TO GET EMAIL ALERTS FOR FUTURE MEETINGS go here. (Input the information and it will say “subscribe to this body” to sign up.)

*** Wasatch County Council passed the County 2020 budget on December 4th, after their public hearing. Here’s the hearing video (click on agenda items to go to specific discussions, notice at bottom of agenda is 6pm public BUDGET hearing) ALL COUNTY BUDGETS The County has several sources of revenue for their budgetary needs, but we want to address the property tax of approximately $16M revenue, including the $1,100,000 increase in property taxes in comments here. The $1,100,000 increase in the Wasatch County General Fund will be used primarily to fund public safety in law enforcement wage increases and stipends for Search and Rescue personnel (who have been serving us with such great results as volunteers for years). We see this as a necessity as the County continues to grow. Even with the increase in taxation, the certified tax rate remains the same at .001863 due to growth in the county.

In 2020 Wasatch County will be losing revenues from ambulance service billings. This will be offset by the reduction in the burden of EMS personnel expenses, purchasing ambulances (cost of approximately $150,000 almost yearly) and funding provided to the Wasatch County Fire District. In 2020, Wasatch County will fund WCFD $900,000 during the transition period of merging Fire/EMS, but that number will decline to $0 in one to three years when Fire will take over all expenses for EMS.

___________________________________

***2020 Wasatch County Fire District tax increase public hearing December 10th at 6pm. Located at 25 N. Main Street, Heber, Utah. WC fire- 2019 budget amended WC fire- 2020 budget The Wasatch County Fire District is now the only fire service in the county, Jordanelle no longer pays a separate “Assessment Area” tax. That is a good thing for Jordanelle property owners. First glance at the above budget bottom line appears to be a big increase in the budget, but please take into consideration that this budget is the first combined budget for Fire/EMS. In 2020, the Fire District has requested a tax increase of $1.4 Mil to fund their merger as Fire will be taking over all the expenses of EMS. As stated above, Wasatch County will assist funding with $900,000 this first year, and the ambulance services billings revenue (estimated to be $850,000) will be collected by WCFD to help offset the expense. In 2021, Fire/EMS hopes to be self supporting through the tax funds collected in 2020, and Wasatch County will look forward to not having to fund the District at all in 1-3 years. The new funds from the tax increase will be used to offset the $900,000 (from Wasatch County general fund) and to hire 6 additional full time cross trained Fire/EMS professionals to provide service to Wasatch County residents and visitors.

Here’s our full commentary- WTPA Fire -Letter to editor

“Many changes have been made at the Fire District. While EMS has traditionally been funded mostly by the Wasatch County General Fund, it will now be funded entirely by the Fire Special Service District. These are two entirely separate taxing entities, and that means shifting the tax burden from Wasatch County over to the Fire District–a tax increase of $1.4 million— which will replace the current funding ($900,000) received from Wasatch County once it is in effect in 2020. This amount will also fund the hiring of 6 new full-time Firefighter/EMS cross trained personnel (approximately $500,000) which are much needed by the District to service the needs of the public as the county population continues to grow. It’s a good start on the path of fulfilling the recommendations of the needs assessment.

Under the leadership of Chief Ernie Giles, we now have a Fire Advisory Board of distinguished fire professionals lending their expertise (without pay) to assist our Fire District in its transition from its mostly volunteer status to professional full time Firefighter/EMS personnel. A Needs Assessment was procured in 2018, and the District has done its very best to comply with the recommendations from the study. One of the highest priorities has been to merge our Fire and EMS services to streamline their functions for improved service to the public, and this is a process that will take a year or two to fully accomplish. Many other improvements have been made by the District, and more are in the works. In fact, in order to lessen the burden on taxpayers, the District has implemented an impact fee on new development that will go into effect in January 2020.”

***2020 Jordanelle watch video- Budget Hearing Dec 10th- JSSD- agenda packet 12-10-19 JSSD-2020-Budget JSSD-2019-Budget-Amended

***2020 Twin Creeks SSD- TAX INCREASE and Restructure.Meeting video here Detailed explanation of new water fee structure.

***2020 Wasatch County Parks & Recreation Special Service District- Public hearing Dec 10th 6pm. Parks and Rec 2020 budget

***2020 Heber Light & Power BUDGET Hearing- Wednesday, November 20, 2019, 6pm at 31 S. 100 W., Heber- HL&P Budget – 2020

Wasatch Taxpayers Association appreciates any, and all, donations to further the cause of transparency and accountability in Wasatch County. Please take a moment and help this ALL volunteer group. Donate tab above, or red button on the right. Thank You!

This website is for educational purposes only, unless it is specifically stated that WTPA has a stance on a specific issue. To the best of our knowledge this is correct information, but we welcome corrections if errors are found.

5 Comments

Shawn Davis

Hi,

I appreciate your time and effort on tax issue.

I had two questions pertaining to the assessed home value and the appeal of 60% or greater increase.

I have my 2016 and 2021 property tax notices, but there are so many columns of values and I am trying to understand what value I’m supposed to use for the calculation.

Is it the primary home value? Total property tax? Total property value?

Secondly, does the 60% calculation apply to non primary land (building lot)?

Something so simple is made into a maze. It makes one want to run for office and work to correct the problem.

Thanks again for your time,

Shawn

Kasey Ring

I find it interesting that my home increased dramatically but my rental property did not. Seems like they pick and choose. What can we do?

Linda Sailer

I appealed my tax bill 2021 and 2022. I have been through hell with the County passed from one Assessor to another Todd Griffin, and the day I went to State appeal another assessor was sent Heather, as Todd Griffin back August 2022 agreed that I had been over assessed in 2021 and therefore also i 2022. He agreed county would adjust my assessed value to a number we came up with and send the stiputlation to the State. After that 2 hr meeting in the assessors office I did not hear from him for a month. I finally got through to him and all he said was “I’m in a pickle for working this out with you”. Next thing I knew I had to go to State appeal before a Judge with assessor Heather wHo I had never met, and did she did not have a file on me, or any of the comps he and I agreed on, which I had sent the state to update them. It was a herrendous experience, and I have still not heard from the Court, hearing was October 17th. It would take me two hours to tell you of what I have been through. My taxes since 2016 when I bought my home back from buyer I sold to, till 2022, have doubled.

I am printing this whole informational package out for futher appeals.

I am totally disgusted with the. Assessors office, and how Todd Griffin hide out from Court by sending someone else in his place. That was he did not have to lie under oath.

Sincerely, Linda Sailer

Pingback:

Pingback: