Heber City

8-11-21 Heber City is having a Truth In Taxation Hearing on Aug. 11, 2021, 7pm at their council chambers on 75 N. Main Street.

We sent them a letter stating that they should wait to get our Wasatch County Tax Assessments correct before they even consider a tax increase at this time. WTPA letter to Heber Council- tax increase Here’s our explanation in a Wasatch Wave Letter to Editor

Heber City should NOT raise taxes and make this tax assessment problem worse. Email your comments to them before Wednesday’s hearing at: CCPublic@heberut.gov Click here for the full story of the Wasatch County Assessment problem.

**Councilman Ryan Stack commented on facebook in support of the tax increase-

**Council woman Rachel Kahler commented on facebook AGAINST the tax increase-

_____________________________________________

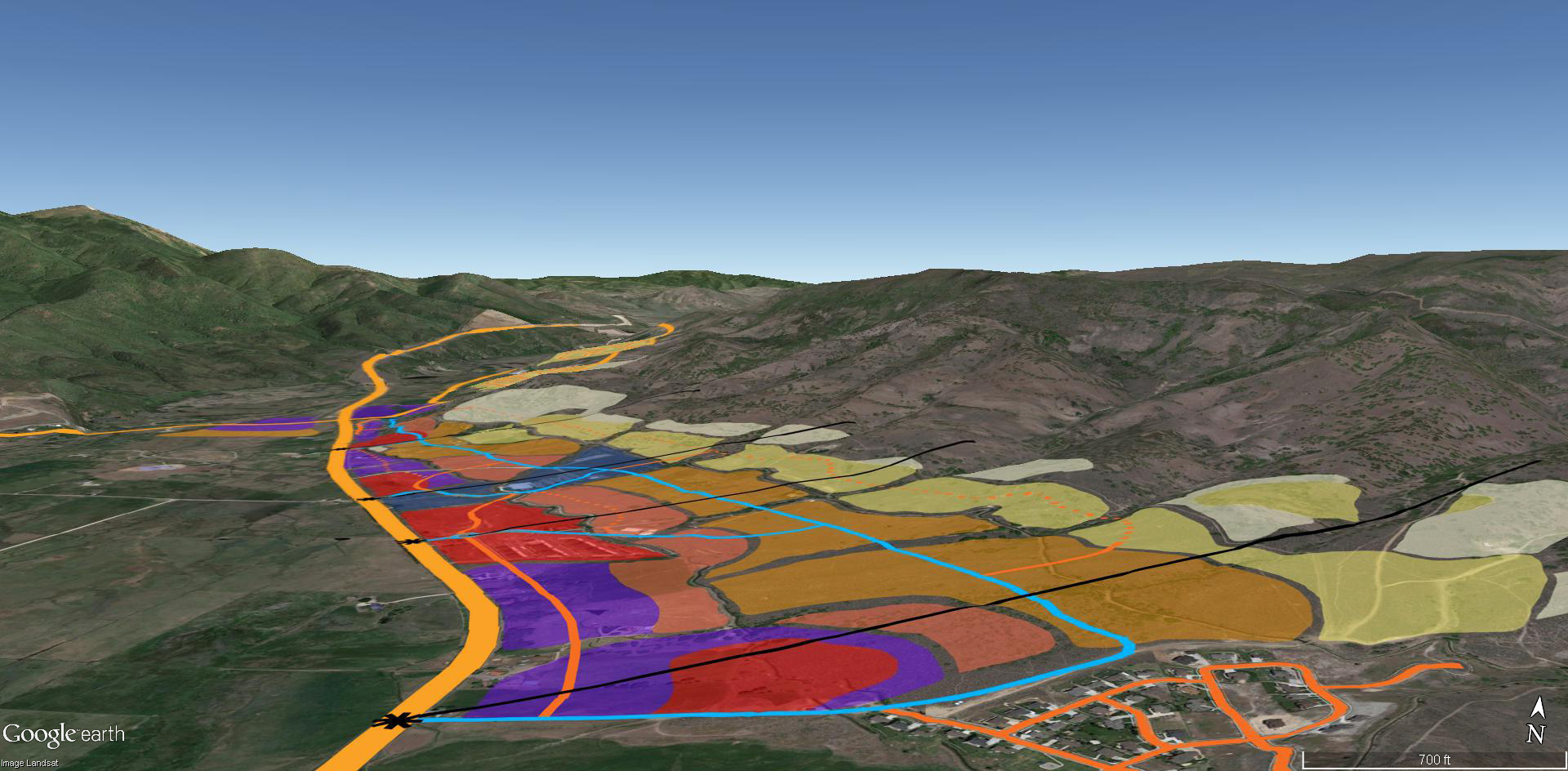

8-20-20- Heber City is considering a ton of developments in the NEW North Village area they wanted in their city limits, and these developers were just assuming they could allow all their storm drain water to flow to the West of Highway 40, into the North Fields and eventually into the Provo River. Now the North Fields Irrigation Company has said that they will not allow ANY water to enter their system- North Fields Irrigation letter- storm drain 8-20-20 . The Deer Creek Reservoir also has had algea blooms this summer. KPCW REPORT. The health of our agricultural fields, Provo River and Deer Creek Reservoir is at stake. Read more on algae blooms here.

8-20-20- Heber City is considering a ton of developments in the NEW North Village area they wanted in their city limits, and these developers were just assuming they could allow all their storm drain water to flow to the West of Highway 40, into the North Fields and eventually into the Provo River. Now the North Fields Irrigation Company has said that they will not allow ANY water to enter their system- North Fields Irrigation letter- storm drain 8-20-20 . The Deer Creek Reservoir also has had algea blooms this summer. KPCW REPORT. The health of our agricultural fields, Provo River and Deer Creek Reservoir is at stake. Read more on algae blooms here.

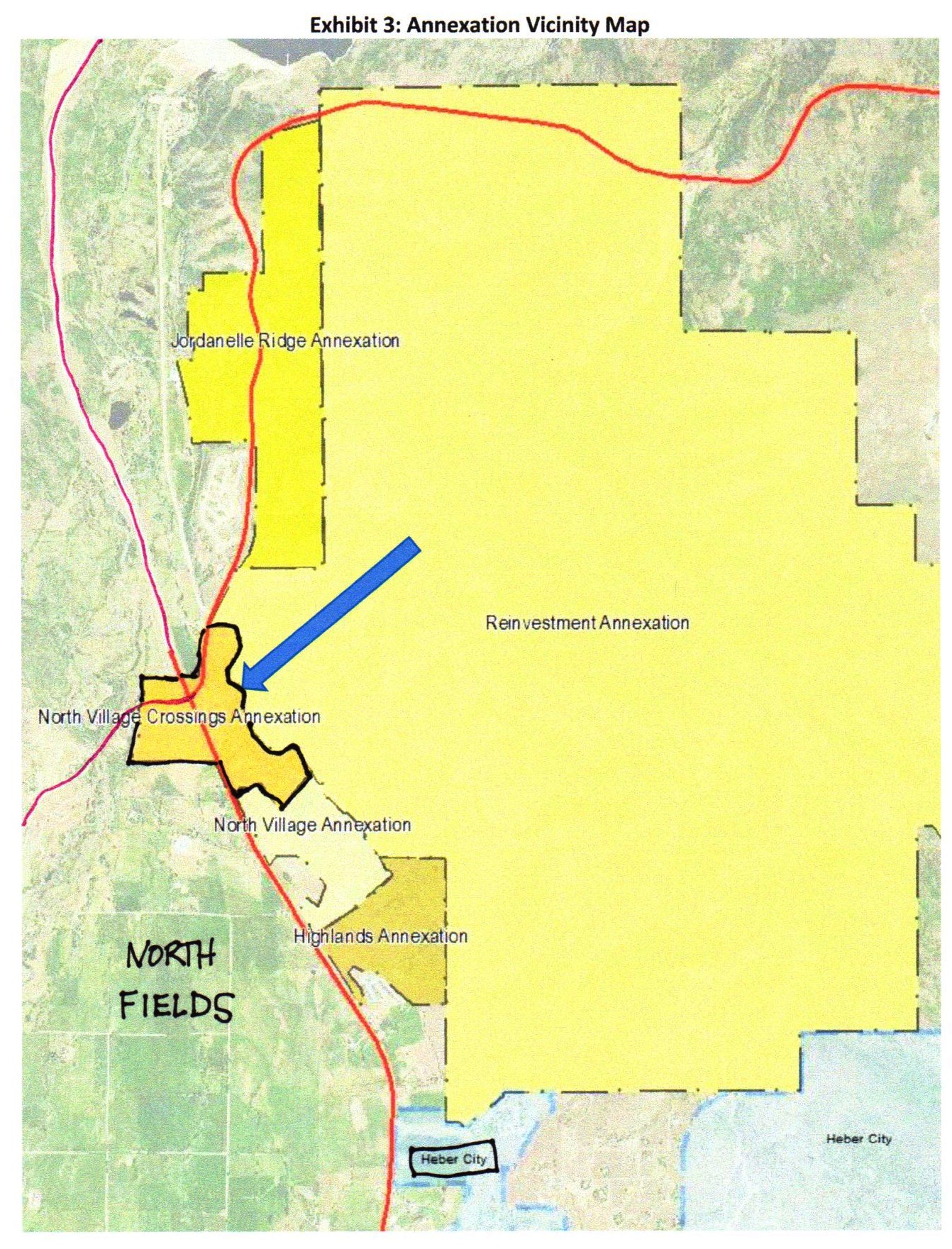

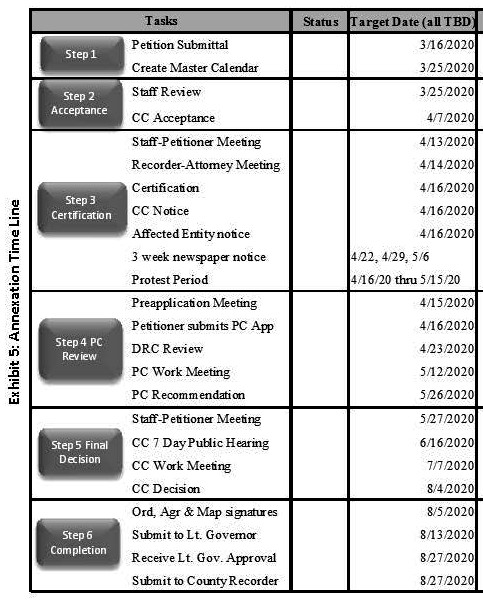

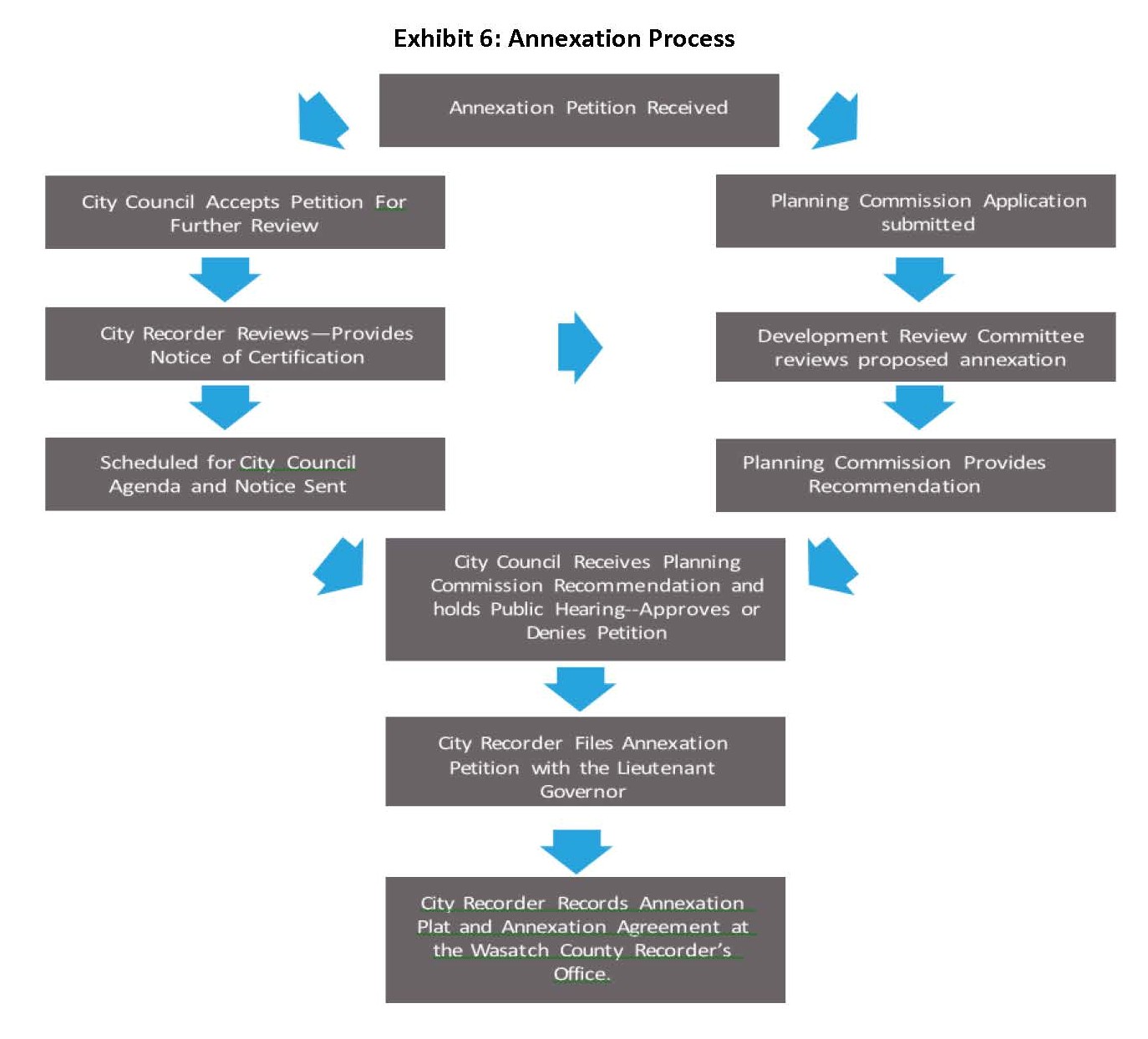

4-7-20 The most iconic intersection in Wasatch County is now applying to be annexed into Heber City. The staff report of the North Village Crossings will give you the basic knowledge of the development. Scroll further down for the upcoming timeline of the annexation process. Heber Council- N. Village annexation staff report 4-7-2020 and Heber City meeting audio and agenda. (Click on agenda item under audio to prompt to discussion #2)

(Click picture to enlarge)

The public has been very clear during the Envision 2050 General Plan process this past year. Numerous public hearings and surveys were conducted. Here are two surveys that show the public’s priorities when it comes to open space, high density development and the North Fields. See here: Envision 2050 North Fields survey Envision 2050 Open Space survey Even 10 years ago it was obvious- North Fields- Heber 2010 survey comments

Here’s the timeline and process on the upcoming annexation petition: (Click pictures to enlarge)

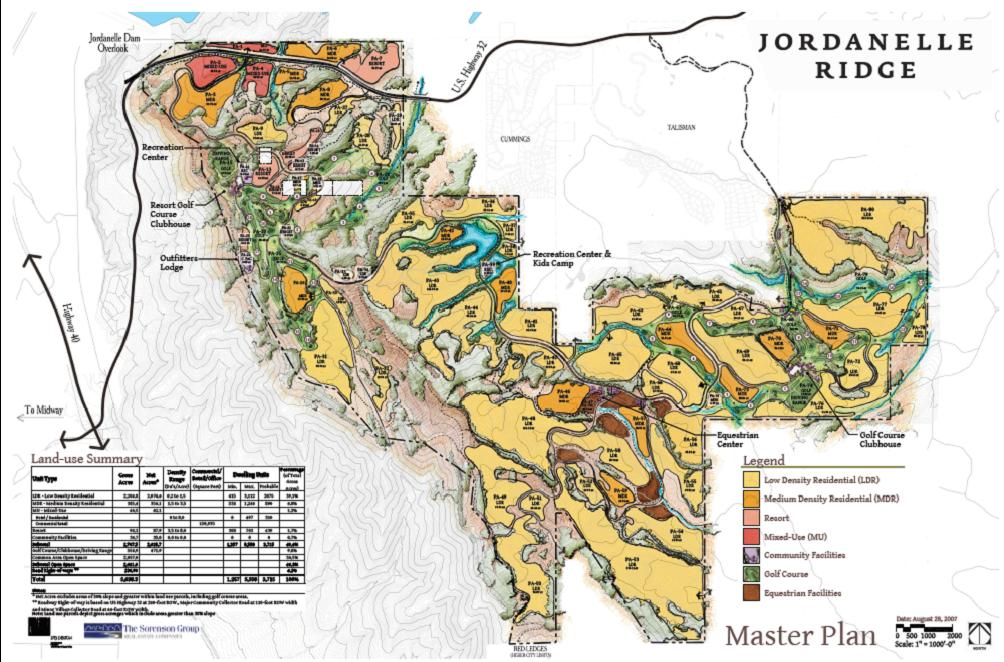

The Wasatch County Council had this development agreement, but there were a few conditions that would have had to be met by developer(s). 2015- OLD N. Village dev agreement Wasatch Co Wasatch County granted a conditional master plan and density determination. The development agreement has a number of conditions that must be complied with. These conditions will be expensive for the developer but were a required trade-off for the high density approved. They included: underground parking for 1,066 stalls to enhance pedestrian and village feel, restrictions in the CC&R’s so dwellings are maintained as second homes so that taxes are assed at 100% of value, 8’ asphalt trail around the perimeter of the development with approval of phase 1 commercial pads which includes all landscaping along River Road and Highway 40, Indoor water park, members lodge and village plaza with roughly 65,000 square feet including restaurants and movie theatres, no apartments are allowed only ownership units, requirement to comply with materials and renderings approved at master plan, etc.

Heber City passed an MOU with Wasatch County in 2019 to honor the densities that Wasatch County already approved, and for Heber City not give more density in the future. Heber City Expansion Area MOU 2019. There have been many discussions between Wasatch County and Heber City about the MOU involving Heber’s future annexation plans. (To give Wasatch County a comfort level on Heber annexing their special service districts) Check out some of them here: Wasatch Taxpayers Youtube page

Here’s what the East side of Highway 40 will look like, since it was approved by Wasatch County 15, or so, years ago. Do we need more high density commercial on the West side, where sensitive wetlands, habitat and the vulnerable water shed for down valley users are in jeopardy?

Stay tuned for more information!

_________________________________________

6-11-19 The power poles are baaaaacckkk! The Heber Planning Commission heard from Heber Light & Power and Rocky Mountain Power on the conditional use of the height and width extensions needed for the power upgrade. The Heber City Council, in their infinite wisdom, changed their code in the past year to change the entity that needs to review the power pole conditional use process from their Board of Adjustments to their Planning Commission. They also required TWO public hearings before a decision can be made, which includes the public much more. The second public hearing has not been scheduled yet, at the time of this posting. Stay Tuned!!!! There were many good questions asked here, that were not asked at the Wasatch County Planning Commission the previous week, so it’s worth watching these videos. See the discussion here: Wasatch Taxpayers Youtube page

6-11-19 The power poles are baaaaacckkk! The Heber Planning Commission heard from Heber Light & Power and Rocky Mountain Power on the conditional use of the height and width extensions needed for the power upgrade. The Heber City Council, in their infinite wisdom, changed their code in the past year to change the entity that needs to review the power pole conditional use process from their Board of Adjustments to their Planning Commission. They also required TWO public hearings before a decision can be made, which includes the public much more. The second public hearing has not been scheduled yet, at the time of this posting. Stay Tuned!!!! There were many good questions asked here, that were not asked at the Wasatch County Planning Commission the previous week, so it’s worth watching these videos. See the discussion here: Wasatch Taxpayers Youtube page

______________________________________________

9-27-2018 Heber City presented an update to the Park City Board of Realtors – see presentation here. Heber PPT- Luncheon PCBOR 2018

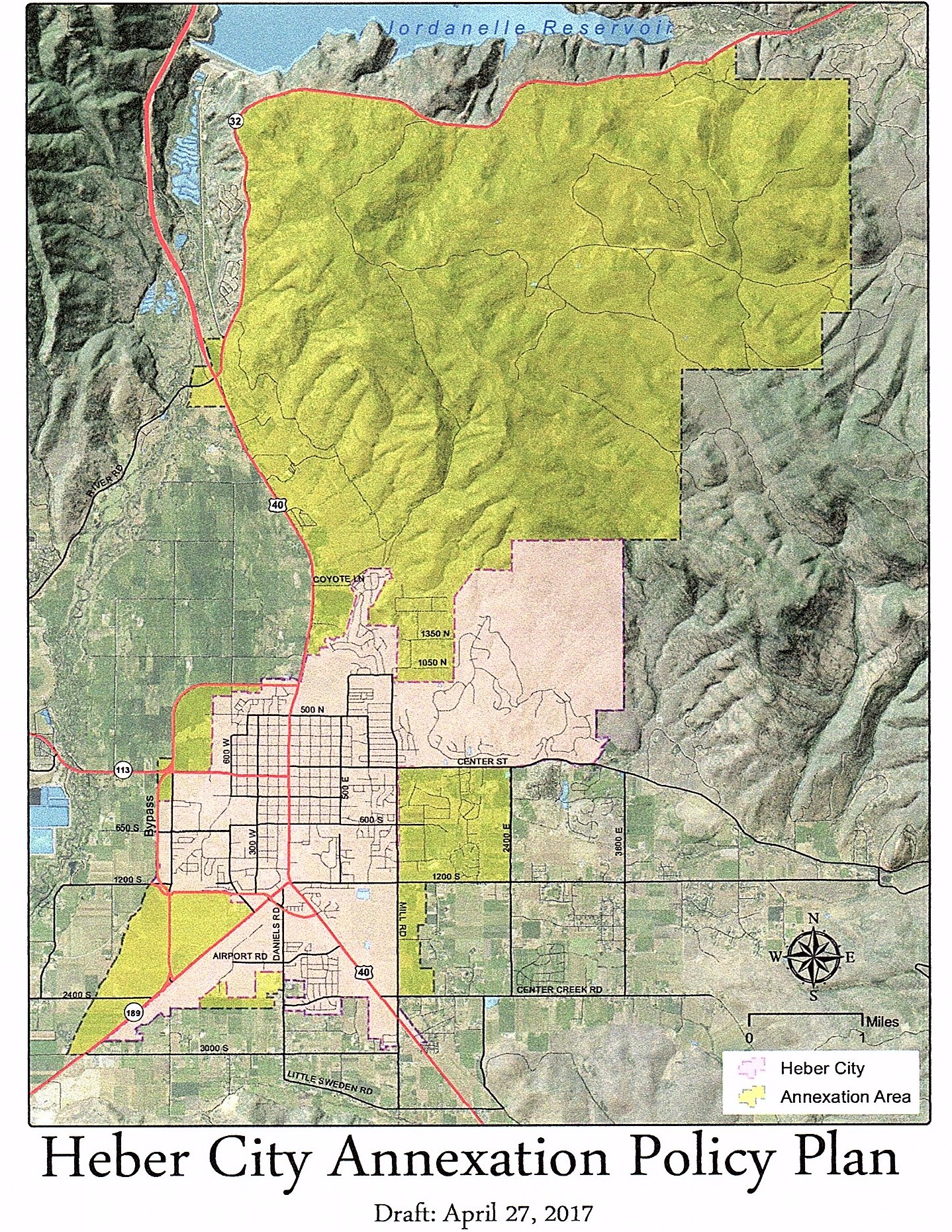

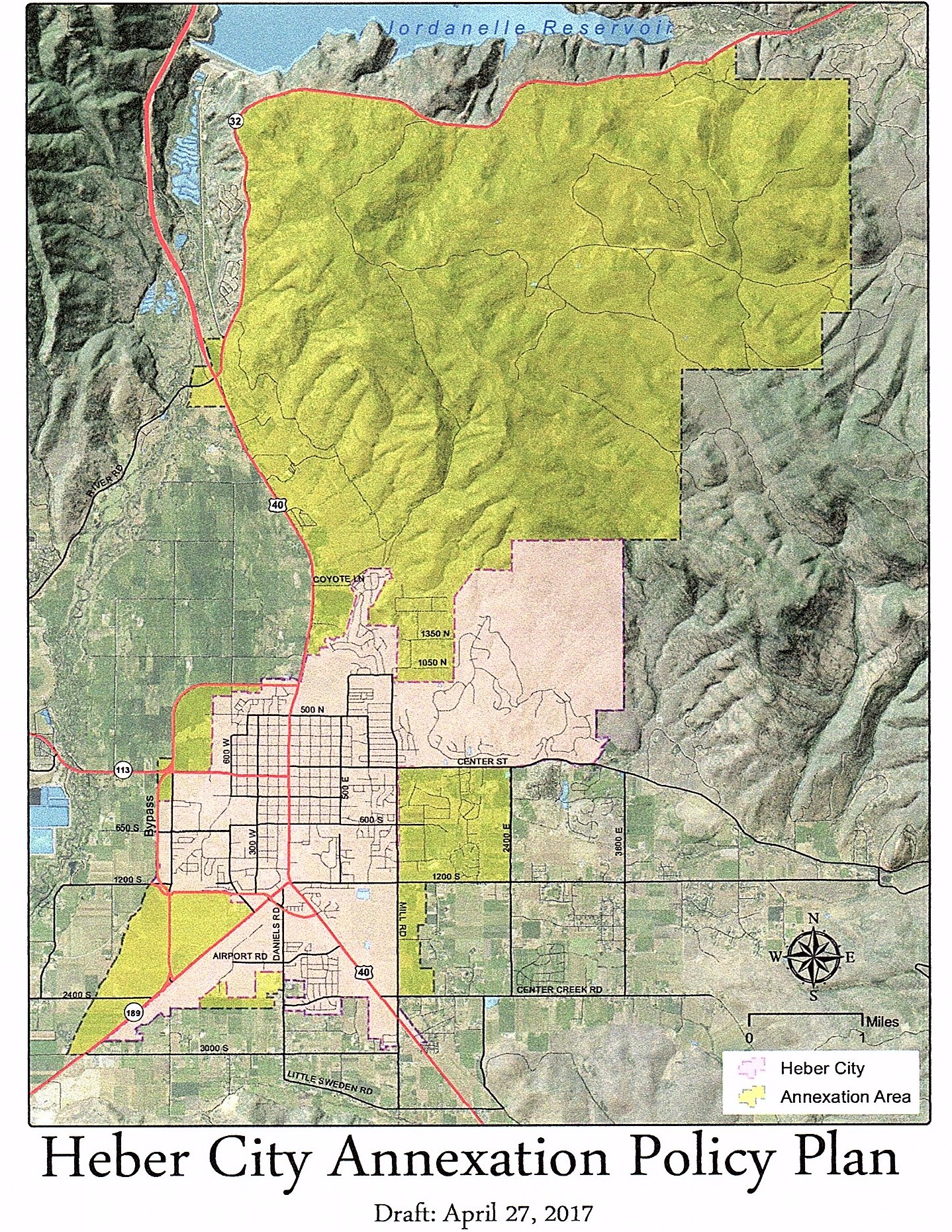

3-1-18 The Heber City Annexation Policy Plan with proposed amendments will have a public hearing scheduled for March 1, 2018 at 6:00 p.m. in Heber City Hall at 75 North Main Street in Heber City, Utah. (click on picture to the left to enlarge) Here’s the proposed DRAFT Annexation Policy Plan. Watch public hearing here: Wasatch Taxpayers Youtube page —–Heber City is considering more than doubling in size and population, and it must be noted that Heber City’s main reason to annex anything is to fund their NEW $6.3 MILLION Public Works building that will be funded by future impact fees for new development, envisioned by the Heber City manager. Originally, the project was projected to be $8 MIL but the city council voted for a $5.5 MILLION project- but it didn’t matter because now it’s almost $1 MIL over budget. Most of that project is being built for FUTURE development not current needs, but the city council voted (only Heidi Franco voted against it) to BORROW another $750K and spend another $400K+ out of the enterprise funds and impact fees to make up the difference. Is this what the CITIZENS want, and is this being fiscally responsible??

The green area north of Heber City is Jordanelle Ridge development, also known as Sorensen Property which has approx. 9,000 acres above the UVU College campus, approached the county council to re-evaluate the ERU’s (Equivalent Residential Units) and to move 700 ERU’s out of the lower area of the North Village to their new master plan on the upper part.  (click on picture to the left to enlarge) Here’s the county’s PPT presentation from the meeting back in April 2017, on the issues involved with this development-Jordanelle Ridge PPT- PDF 2017T This development, when built out, will increase our county population by 18,000 people. Heber City’s current population is around 14,000. Yikes. See the plan here: Wasatch Taxpayers Youtube page There’s also another development EAST of Jordanelle Ridge, within this green NE annexation area, that was previously called Talisman. It was just purchased and a new development will be forthcoming.

(click on picture to the left to enlarge) Here’s the county’s PPT presentation from the meeting back in April 2017, on the issues involved with this development-Jordanelle Ridge PPT- PDF 2017T This development, when built out, will increase our county population by 18,000 people. Heber City’s current population is around 14,000. Yikes. See the plan here: Wasatch Taxpayers Youtube page There’s also another development EAST of Jordanelle Ridge, within this green NE annexation area, that was previously called Talisman. It was just purchased and a new development will be forthcoming.

11-13-17 The Heber City Annexation Policy Plan with proposed amendments will have a planning commission public hearing scheduled for November 30, 2017 at 6:00 p.m. in Heber City Hall at 75 North Main Street in Heber City, Utah.

This document is in response to Wasatch County’s concerns about Heber City considering annexations into Heber City that are currently in existing special service districts formed by Wasatch County over a decade ago.

7-20-17 Heber Historic Building Preservation was discussed at the Heber Council meeting after the Karl Malone building was demolished without the community OR COUNCIL having a head’s up that that was going to happen. Historic preservation is high on the priority list of Heber Planning Dept, and a citizen brought Midway City’s ordinance for the Heber Council to review. The mayor wants to get the historic committee meeting again, and the council discussed how to better notify the city when an owner wants to demolish a building so it can have a better chance of being saved.

7-20-17 Heber Historic Building Preservation was discussed at the Heber Council meeting after the Karl Malone building was demolished without the community OR COUNCIL having a head’s up that that was going to happen. Historic preservation is high on the priority list of Heber Planning Dept, and a citizen brought Midway City’s ordinance for the Heber Council to review. The mayor wants to get the historic committee meeting again, and the council discussed how to better notify the city when an owner wants to demolish a building so it can have a better chance of being saved.

Listen to the video: Wasatch Taxpayers Youtube page

_____________________________________________________

7-20-17 Heber City Council and planning staff discussed the Annexation Interlocal agreements that the Wasatch County Council sent to Heber City. Heber Annex- Boundary declaration agmt Heber Annexation- Wasatch Co Interlocal agmt

7-20-17 Heber City Council and planning staff discussed the Annexation Interlocal agreements that the Wasatch County Council sent to Heber City. Heber Annex- Boundary declaration agmt Heber Annexation- Wasatch Co Interlocal agmt

The Heber Planner, gave a presentation that outlined all his concerns about the Interlocal plan, but some council people wanted to keep this negotiation between the councils (not staff). Heber Annexation- Heber planning Interlocal PPT This presentation is referenced in the videos below. Watch the interesting discussion here- 2 videos: Wasatch Taxpayers Youtube page

5-31-17 Heber City and Wasatch County councils met in a special meeting to discuss Heber City’s proposed annexation map. They needed to work out concerns about Heber’s aggressive encroachment into the county’s special service districts already developed to service these areas with water and sewer. These areas (green in attached map) would more than triple Heber’s current population, and would put the already projected 30 year Heber Valley growth on steroids. The group decided to have a small committee meet to see if they can develop an interlocal agreement to address Wasatch County’s concerns. These councils will then meet again in early July. Watch the discussion here: Wasatch Taxpayers Youtube page

4-27-17 A recent Heber City planning commission meeting included possible changes to the official municipal annexation map. There are some controversial areas that have the interest of Wasatch County, since they say there has been a “gentlemen’s agreement” for years about Heber City not growing EAST of Mill Road (1200 East). Also, there’s a new “town”, above the UVU Campus on the Sorensen Property called Jordanelle Ridge, that will grow to 18,000 people and has been going through their development process with Wasatch County. (More info on this development here). Some public officials from Wasatch County, Jordanelle, Twin Creeks, and North Village SSD’s, and Heber Light & Power weighed in at this HEBER CITY meeting on the impacts to their existing jurisdictions if Heber decides to try to annex these mentioned properties. A county councilman was concerned that this was a formal annexation map meeting instead of Heber City and the county having a much more informal meeting first. Another one cited a possible violation of Utah Code 10-2-403-6 if the annexations are approved by the Heber City Council. These annexations would be encroaching on current Special Service District boundaries created by Wasatch County already (North Village and Jordanelle to the north and Twin Creeks to the east), not just annexing UP TO them. These SSD’s have bonds that current residents are paying off, and if the district loses residents it will increase the payments for the rest. The general manager of Heber Light & Power also had concerns that this northern annexation area was currently serviced by Rocky Mountain Power, but if Heber City annexes it, it would mean HL&P could possibly be taking over that area (Heber City OWNS 75% of HL&P). That’s a huge concern for them if they need to more than double the service area of Heber City proper, which means they would need to grow as well and purchase more power on the open market.

Also, it is not clear if the developer of Jordanelle Ridge approached Heber City to consider annexation, or if Heber City staff approached the developer. In the previous Wasatch County meeting 2 weeks prior, the developer said that they had NOT approached Heber City, but that “Heber City has expressed interest in wanting us”. (Watch video here-look for prompt in video comments) Who at Heber City took it upon themselves to approach the developer and get themselves in the middle of this development agreement with the county? And how is that in the best interest of Heber residents? If this is what happened, this is not the first time Heber staff has taken it upon themselves to approach other public entities, or developers, in the county to involve Heber City without the city council’s knowledge, let alone approval. In the below videos, the city planner was asked point blank by a Wasatch County councilman, ” Who approached Heber City from the Sorensen property?” The city planner replied, “Terry Diehl”. If this is true, it’s quite surprising. How is Diehl involved, and is everyone aware that he was just indicted by a federal grand jury this month? (If it is a different Terry Diehl, then we apologize, but considering this bomb was just dropped in a public meeting without any explanation by Heber City staff, we will correct later if found it is a different person). Terry Diehl’s reputation preceeds his entree into Wasatch County: Terry Diehl allegedly concealed $1M in FrontRunner project Salt Lake Trib 4-21-17 Terry Diehl may be bankrupt – Salt Lake Trib 4-5-17 Terry Diehl owes $41-DesNews 4-2-12 Controversial UTA Board Member Diehl Resigns -Mass Transit Mag 9-10-14

The Heber City planner said that this was not a “formal annexation meeting” yet they talked about moving forward with the next official planning commission PUBLIC HEARING that is required to proceed with the process of altering the official annexation map. Stay Tuned….. Watch the public officials, landowners, developers and citizens weigh in on these annexation issues: Wasatch Taxpayers Youtube page

_______________________________________________________

1-19-17- There may be another $8 Million Heber project in the near future- This time the PUBLIC WORKS facility. The Heber City Council had a poorly attended public hearing on whether they should apply for a CIB loan (low interest 2.5% loan from the same association that financed the Heber public safety building). Heber- Public WORKS facility presentation 1-19-17 Heber- Public WORKS phasing options 1-19-17 Heber- Public WORKS phasing options 1-19-17 __________________________________________________

The Utah Permanent Community Impact Board provides loans and/or grants to state agencies and subdivisions of the state which have or may be socially or economically impacted by mineral resource development on federal lands. Under the Federal Mineral Lease Act of 1920, lease holders on public land make royalty payments to the federal government for the development and production of non-metalliferous minerals. In Utah, the primary source of these royalties is the commercial production of fossil fuels on federal land held by the U.S. Forest Service and the Bureau of Land Management. Since the enactment of the Mineral Lease Act of 1920, a portion of these royalty payments, called mineral lease payments, has been returned to the state in an effort to help mitigate the local impact of energy and mineral developments on federal lands. The state of Utah then allocates 32.5% of the royalties as Permanent Community Impact Funds. The PCIFB will only fund those applications which are submitted by an eligible applicant for an eligible project. State Code for CIB BOARD requirements CIB BOARD MEMBERS

See the discussion of this public hearing here: Wasatch Taxpayers YouTube page

Heber City recording and agenda- Public works is #3 on agenda: http://heber-ut.granicus.com/MediaPlayer.php?iew_id=1&clip_id=417&meta_id=34551

___________________________________________________

11-3-16 Form Based Code update

On Nov. 3rd, the Heber City Council voted to discontinue the form based code and to receive their branding info from consultants. Councilpeople Jeff Bradshaw and Kelleen Potter were assigned to meet with the consultants on the $20,000 BRANDING component alone, and now we will see what we get for the $11,000 that was spent so far. See the discussion on 3 videos here: Wasatch Taxpayers YouTube page

A tale of 2 meetings. See the difference in the attendance of these 2 meetings- October meeting here and the April meeting below? This Oct meeting was packed with folks concerned about the proposed rezone. Most were against the rezone. Listen to full meeting here. The city council begged for public input last spring when they first received the FBC draft from the consultants. It’s great to see so many citizens attending in October, but see attendence in second photo below from April? The city council could have used this public input BEFORE they spent all of the $100,000 on consultants first approved back in 2015, and countless hours of staff time that the taxpayers of Heber City paid for.

A tale of 2 meetings. See the difference in the attendance of these 2 meetings- October meeting here and the April meeting below? This Oct meeting was packed with folks concerned about the proposed rezone. Most were against the rezone. Listen to full meeting here. The city council begged for public input last spring when they first received the FBC draft from the consultants. It’s great to see so many citizens attending in October, but see attendence in second photo below from April? The city council could have used this public input BEFORE they spent all of the $100,000 on consultants first approved back in 2015, and countless hours of staff time that the taxpayers of Heber City paid for.

Documents: form based code-public hearing info form based code-heber letter form based code-FULL draft 10-2016

KPCW radio report on October public hearing- Listen here:

April 2016- The Heber City Council is reviewing a draft of the possible new  FORM BASED CODE. See the current draft here: formed base code draft-heber city. It not only requires buildings to look a certain way going forward, it also does not have a cap on density within the city core. Traffic and increase costs to the taxpayers to impliment this code is of major concern.

FORM BASED CODE. See the current draft here: formed base code draft-heber city. It not only requires buildings to look a certain way going forward, it also does not have a cap on density within the city core. Traffic and increase costs to the taxpayers to impliment this code is of major concern.

__ __ __ __

Some things that must be mentioned. The Heber City Council didn’t initially ask for this FBC to be used throughout the whole city limits. It first became an issue during the Bassett-Richie annexation (north of Smith’s grocery store) in 2015. The city council was thinking that that area would be a good place to try a walkable community to use as a test case for possible further new subdivisions, if they liked the outcome. They hired the consultant, Clayton Vance, to look at only the Bassett- Richie annexation. (See form based code-RFP for consultant) And the intial couple public open houses conducted by Clayton Vance had the packed room of residents choose (and rate) pictures of buildings and commercial developments that they liked and didn’t like. Very superficial info, but very time consuming of an exercise. It DID NOT give the public ANY idea of what type of zoning laws, impacts, nor constraints would be placed on Heber residents.

When the city council finally received the FBC plan from the consultant, it included the whole city and it seemed like they overstepped their initial instructions. That was NOT what the council voted on, nor instructed the planning dept. to do. Who approved the expansion of the original scope of the work? The planning commission went through the whole FBC plan for months with the consultants. How did it get expanded to the whole town? It seemed to be a surprise to the council, and once the council received it they ended up being buried in code and much more information than they had intended. Was that intentional by the consultants? And why did we pay $110,000 for the Bassett-Richie FBC plan, when we got the whole town for that? It makes it look like we were overcharged for the Bassett-Richie plan.

The takeaway? We hopefully received some good information by the consultants on a whole list of zoning issues we may want to consider in the future? One can only hope, for the amount the city spent. Hopefully citizens will be paying better attention on what issues come up in the future. We still have airport expansion, new annexations, increase water and sewer fees, possible construction of more Heber City gov’t buildings, and rapid growth issues coming up soon. It would be great to see all the people involved with the FBC over reach, to stay involved moving forward so our city council has ALL the public input they need to make good decisions for their constituents.

___________________________________________________________

For the latest Heber Airport Expansion news click here.

For the latest Heber Airport Expansion news click here.

_______________________

… New Heber City Council people were elected and have been sworn in this January 2016! City Council is now: Jeff Bradshaw, Heidi Franco, Kelleen Potter, Ron Crittenden, and Jeff Smith. Heber City website with COUNCIL contact info.

________________________________________________

2-4-16 RED LEDGES UPDATE! Heber City is still caught between 2 developers’ (Red Ledges and Stonecreek) ongoing dispute about their common boundary, bypass road construction, and access issues. The surrounding residents are getting tired of the delay, and the ongoing meetings and endless negotiating between the city and Red Ledges, which ultimately effects their traffic and water pressure issues. The Heber City council finally made a motion to have Red Ledges immediately deliver the water easement to the city, that should have been turned over to the city in 2007. Now a few people representing the different parties (city, RL, and Stonecreek subdivision) will meet and see if they can come to terms. Watch the videos of this latest discussion here: Wasatch Taxpayers YouTube page

1-21-16 RED LEDGES – The city is still negotiating the bypass road delay, and Stonecreek Subdivision is concerned that the city MAY be siding with Red Ledges over their subdivision. Red Ledges and Stonecreek are not getting along, they have easement problems since they are adjacent properties, and may sue each other. Stonecreek is needing a water line easement from Red Ledges to start their subdivision. Red Ledges admitted that they are not financially prepared to begin construction of bypass road this spring, to be completed by their deadline of Oct 2016- even though the city has allowed them to postpone numerous times before. The city council should get legal guidance, and be careful NOT to get drawn into the problems of 2 developers. See the 4 videos of discussion with both parties here: Wasatch Taxpayers YouTube page

12-3-15 Red Ledges is asking Heber City for a postponement of the building of the Eastern bypass road (near Red Ledges). It is currently scheduled for completion OCT 2016, but now Red Ledges doesn’t think they need to build it based on traffic. (and it was asked by a councilman in the 1-21-16 meeting whether Red Ledges was prepared to start the road this spring, and RL said they were not financially prepared). See the video of discussion with both parties here: Wasatch Taxpayers YouTube page

They were supposed to turn over the easement for the road to the city at the execution of the Interlocal agreement back in 2007. The city wants the easement to begin building a much needed Lake Creek water line to improve the water pressure within the city. Did Red Ledges honor the intent of the original agreement by not transfering the easement to the city as agreed to in the interlocal agreement 8 years ago? Are they strong arming the city NOW to get ANOTHER delay on the bypass? Red Ledges- Interlocal Agreement 2007

________________________________________________

8-2015 – UDOT agrees to install HAWK system for pedestrians at 250 S. Main! KPCW radio interview After Wasatch County citizens and Heber City Council shared concerns for years, UDOT has agreed to help with the traffic on Main Street, Heber. At the August 20th Heber City Council work meeting, UDOT said that they will install crossing by the winter of 2015.

_____________________________________

The Heber 32% tax increase was the last proposition on the Heber City Ballot in November 2014. Heber City Prop 10 Nov 2014 ballot (see all election results in the “Election 2014” tab at the top of page) Even though the notice was placed at the polling places that this vote would not be counted, the results were published anyway. Almost half of the registered voters in Heber City voted on this proposition, and over 57% of voters were against this property tax increase. NOW WHAT? The City Council in the past said they will listen to the people’s wishes, and the new mayor and 2 councilwomen RAN LAST NOVEMBER on that exact premise. Will they?

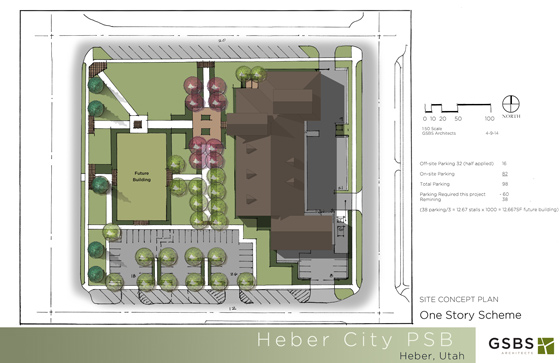

Heber City’s building a new $7.8 million public- safety building on the old Central School property across Main Street from the city park. Even though MOST Heber residents agree that we need a new public safety building building, some believe that 24,000 sq.ft. for only the police and the justice court (which they currently use only twice a week) may be excessive. Go here to see the Heber City website that shows more pictures. This is only half the project that the city has planned- next up will be a new CITY BUILDING for the administration (where it says “future building” on below plat). Who knows how much that will be?? The city council raised Heber City citizen’s property taxes 32% to pay for this project in August. Citizens tried to get a referendum petition signed, to have it put on this NOV. ballot, but fell a little short.

The CIB (Community Impact Board) granted the Heber City Council a 1.5% interest loan for $6.8 million. On their website they state that the maximum they will award is $5 million. The Zion’s Bank representative for Heber City said in August that Heber probably would not receive that money now, since the CIB Board has been running out of money for other smaller, poorer counties in Utah. Does Wasatch County fall into the parameters for this program? Are we considered poor? Well, we got it, so GOOD for us!

State Code for CIB BOARD requirements CIB BOARD MEMBERS

The Utah Permanent Community Impact Fund Board provides loans and/or grants to state agencies and subdivisions of the state which have or may be socially or economically impacted by mineral resource development on federal lands. Under the Federal Mineral Lease Act of 1920, lease holders on public land make royalty payments to the federal government for the development and production of non-metalliferous minerals. In Utah, the primary source of these royalties is the commercial production of fossil fuels on federal land held by the U.S. Forest Service and the Bureau of Land Management. Since the enactment of the Mineral Lease Act of 1920, a portion of these royalty payments, called mineral lease payments, has been returned to the state in an effort to help mitigate the local impact of energy and mineral developments on federal lands. The state of Utah then allocates 32.5% of the royalties as Permanent Community Impact Funds. The PCIFB will only fund those applications which are submitted by an eligible applicant for an eligible project.

__________________________________________

11-13-13- Heber City has already applied for a loan for their proposed PUBLIC SAFETY BUILDING.Here are the only 3 documents given by Heber City so far.

11-13-13- Heber City has already applied for a loan for their proposed PUBLIC SAFETY BUILDING.Here are the only 3 documents given by Heber City so far.

Heber City- CIB FULL Application 10-1-13 Heber-RFP 2008 Needs Assessment Heber- Pubic Safety bldg RFP 2013

$1.1 mil from Heber City budget + $6.7 mil loan= Total cost $7.8 mil./ 22,000 sq.ft and supposedly $175 per sq.ft. It is being built NOW to handle a 25 year increase in population. No plans to build in phases when they need to grow, but want to built it all now.

Heber does not have a design yet, but Heber City wants to have a presentation at their November 21st meeting at 7pm. Heber has already applied to the CIB (Community Impact Board) to hopefully receive a 1.5% interest loan for the $6.7mil, but part of the application process was to show the CIB that the public is behind this project. Heber City has yet to inform the public to get their support, hence the Nov 21st meeting. Heber says it would be a 30 yr term, with a $279,000 debt service, it would be a 35% increase in Heber City taxes, or 3% on individual tax bills. They are also claiming on a $250,000 home there would be a $4.60 a month increase on HEBER CITY taxes. More info to come when they release it!

____________________________________________________

Heber Voters 2013:

Hopefully this will assist in you decision in the upcoming election.

With the Heber City Municipal Election fast approaching, voters need to become educated on the candidates. Here is a podcast of a discussion/debate on the IMPACT Program among the four candidates, seeking to represent Heber residents on the City Council:

City council voted their own pay raise 8-2012 : Heber City pay raise- voted for option 1

Heber City/ BYU Survey Heber Survey Results 2010

Heber City Demographics: HeberDemographics

http://www.hebervalleybusiness.com/facts

Heber City recordings and minutes to meetings: (check in right hand column) http://ci.heber.ut.us/government/citycouncil/index.html

IF YOU MADE IT TO A HEBER CITY MEETING PLEASE CONTACT US WITH INFO OF THAT MEETING. SEE TAB AT TOP FOR “JOIN US” AND YOU CAN LEAVE US A MESSAGE THERE. THANKS FOR THE SUPPORT!

This website is for educational purposes only, unless it is specifically stated that WTPA has a stance on a specific issue. To the best of our knowledge this is correct information, but we welcome corrections if errors are found.